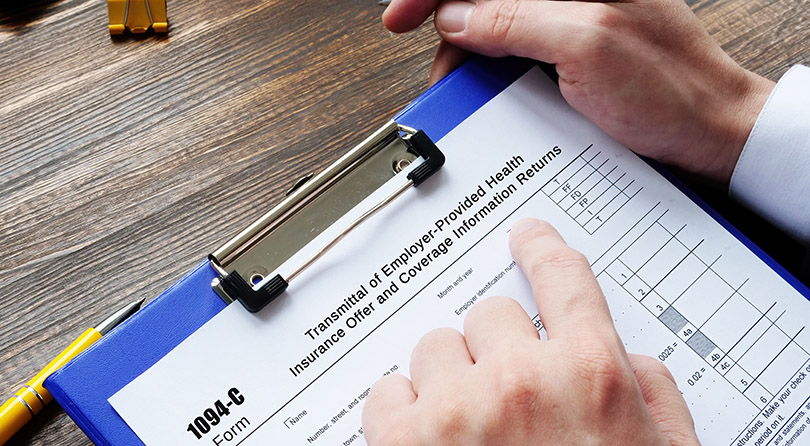

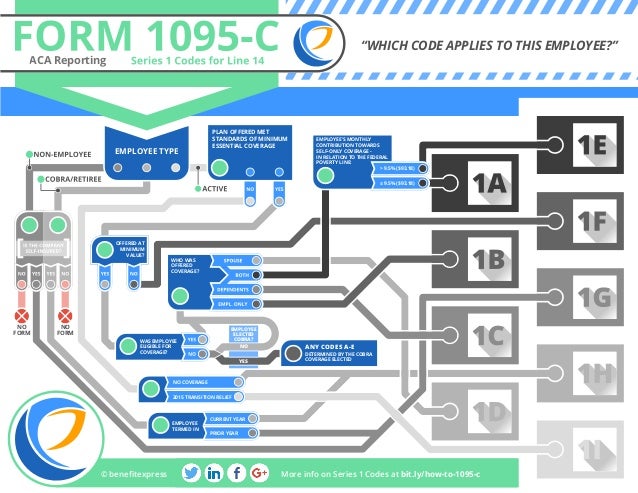

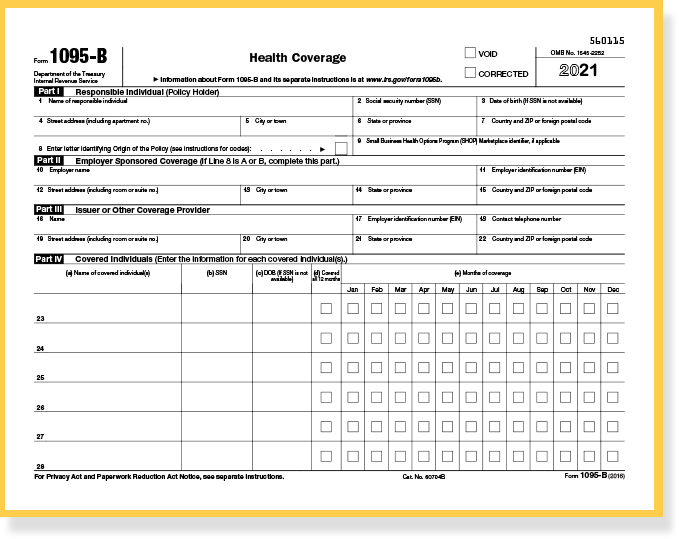

Forms 1095C and 1094C Form 1095C has two purposes 1 Establish the employer's compliance with the Employer Mandate 2 Provide information that will be used by the IRS in determining whether an individual is eligible for premium assistance when obtaining coverage through a Marketplace and will assist the IRS Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out by the insurance provider rather than the employer Form 1095 C Line 14 Offer of Coverage Line 14 describes the health coverage plan that you offer

Form 1095 C Guide For Employees Contact Us

1095 c form codes 2020

1095 c form codes 2020-Form 1095C, Part II, the ALE Member must enter code 1G on line 14 in the "All 12 Months" column or in the separate monthly boxes for all 12 calendar months, and the ALE Member need notLearn More Have questions about meeting the ACA Reporting in 22 with the new changes?

The Codes On Form 1095 C Explained The Aca Times

Eleven IRS Form 1095C Code Combinations That Could Mean Potential Penalties The 1095C form is used by employers with 50 or more fulltime and fulltime equivalent employees (also referred to as applicable large employers or ALEs) to report information required under Section 6056 of the Affordable Care ActYou are receiving this Form 1095C because your employer is an Applicable Large Employer subjectForm 1095C IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit Line 14 of the

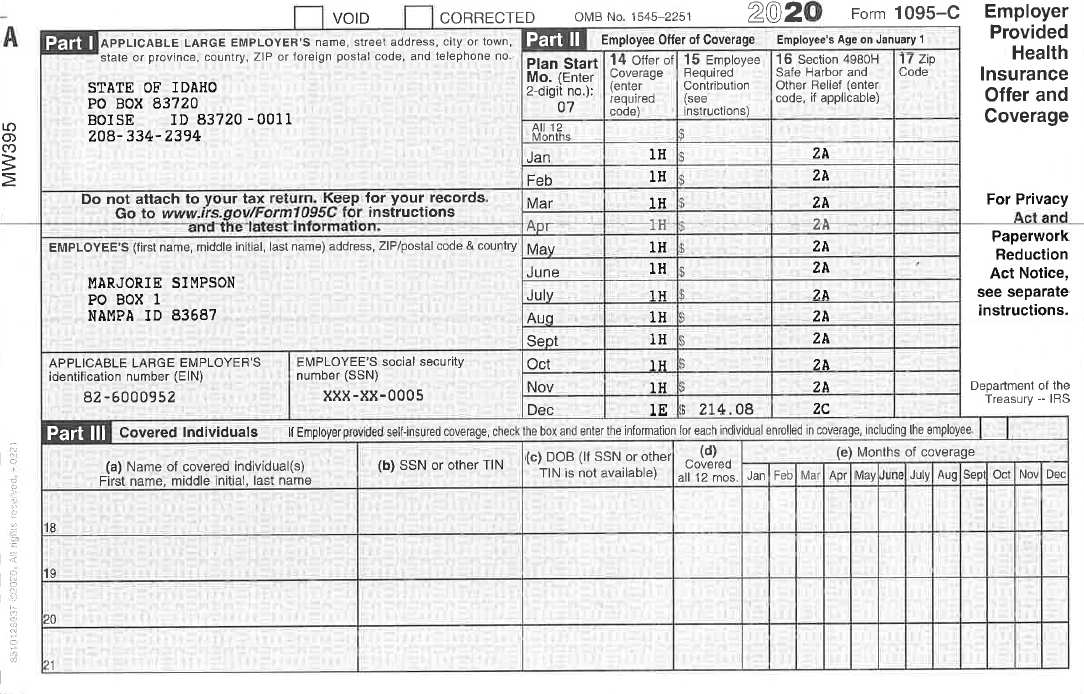

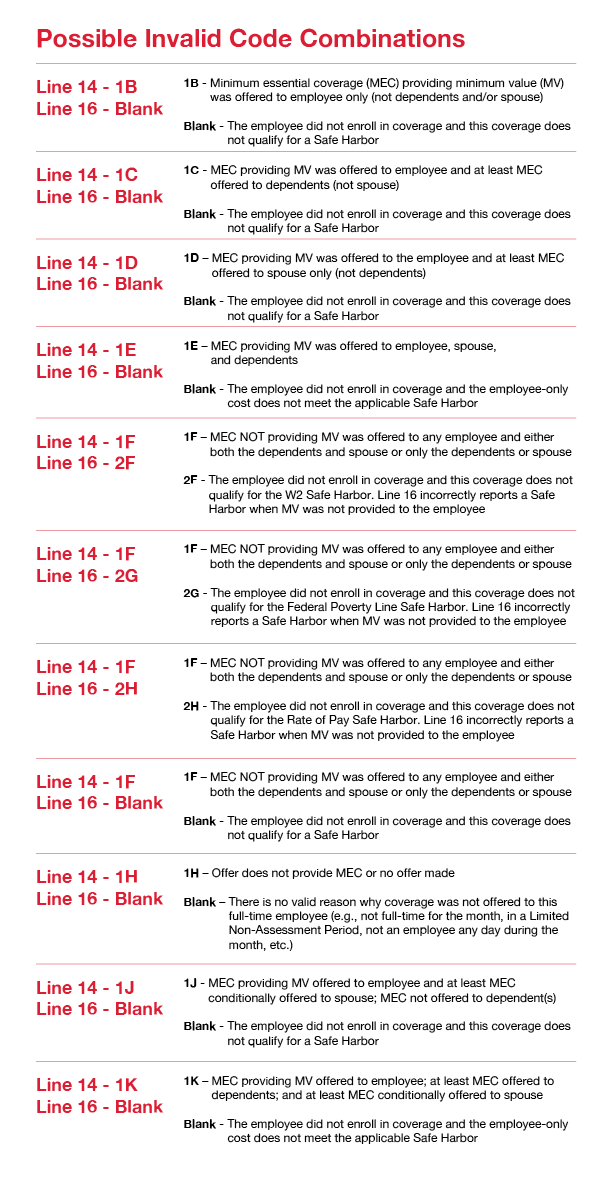

Last week our Health Care Reform article explained the Codes for completing Line 14 of Form 1095C This week we focus on completing Line 16 of Form 1095C Applicable Large Employers (those with 50 or more fulltime/fulltime equivalent employees in the prior year) should be in the process of completing their ACA formsLine 14 Codes SelfInsured Employer with NonFT EE A few notes regarding selfinsured coverage •All employees who enroll in selfinsured coverage must receive a Form 1095C This includes nonfulltime employees per the below scenario •Employers are required to complete all three parts of the Form 1095C only for5 ACA Form 1095C Line 16 Codes, Section 4980H Safe Harbor and Other Relief Line 16 of Form 1095C is used to report information about the coverage that an employee enrolled in, and how the ALEs meet the employer shared responsibility "Safe Harbor" provisions under Section 4980H

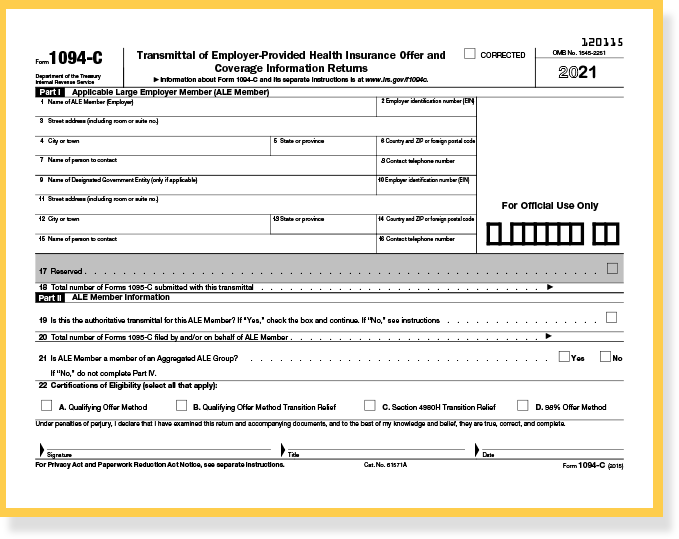

ACA Form 1095C Filing Instructions An Overview Updated 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employees Tacchino said the indicator codes on lines 14 and 16 in part 2 of the form are by far the most complicated component of Form 1095C Employees may ask what the codesForm 1095C is divided into three parts Part I is used to identify the employee, and the reporting ALE entity It includes demographic information such as name, contact and demographic information, Social Security Number (SSN) and Employer Identification Number (EIN)

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

1

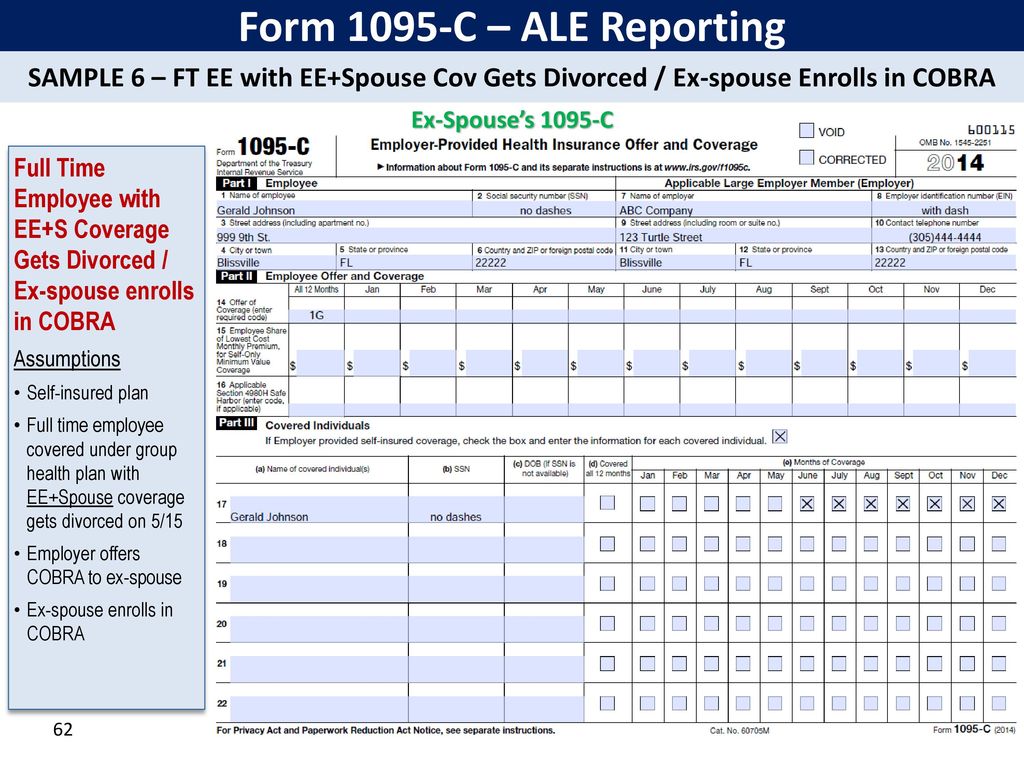

If using form 1095C for COBRA reporting, you would enter codes 1G and 2A in part II lines 14 and 16, respectively Line 15 is not required as affordability is not assessed for COBRA individuals Do retirees who receive health insurance benefits need form 1095CCode Series 1 for Form 1095C, Line 14 Updated For Administrators and Employees Line 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverage offered, and The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information

United Benefit Advisors Home News Article

The Codes On Form 1095 C Explained The Aca Times

Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee Home 18 1095C Codes 18 1095C Codes For more information on how we can support your ACA reporting needs click here any month for which the ALE member checked the " No " box on Form 1094C, Part III, column (a)) For more information, see the instructions for Form 1094C, Part III, column (a) Form 1095C contains a series of codes that indicate employee health insurance coverage For traditional health coverage, applicable codes include 1A through 1H If using a benefits administration software that automates the Form 1095C process, the software should populate the codes for the months they were enrolled in coverage

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

03 Code Series 1 – Line 14 05 Code Series 2 – Line 16 06 Filling Out Form 1095C Page 2 Want to learn more about preparing and filing Forms 1094C and 1095C?Understanding how to choose Form 1095C codes for lines 1416 can be overwhelming Managing ACA compliance all year is challenging enough, but it's essential to select the appropriate codes for Forms 1095C If you enter incorrect codes, it could mean ACA penalties and more time spent fixing those errorsInst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C

2

Www Unifyhr Com Wp Content Uploads 18 09 Unifyhr Insiders Guide To Form 1095 Pdf

1095C 14–Code 1 Series 1 code must be entered in line 14 to indicate the type of coverage offered (or no coverage offered) to the employee and family Enter a code for each month, or enter one code in the "all 12 months" box if the same code applies for the entire calendar yearForm 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility "Safe Harbor" provisions of Section 4980H The table below explains the code series 2The type of coverage we report on Form 1095C is employersponsored coverage Below is a table explaining the different codes used on line 14 You can also find an explanation of the codes on the back of your Form 1095C Code Explanation 1A This code used is when an employer offered MEC providing minimum value to fulltime employees

Www Unifyhr Com Wp Content Uploads 18 09 Unifyhr Insiders Guide To Form 1095 Pdf

Aca Code Cheatsheet

ACA Form 1095C Line 16 Applicable Section 4980H Safe Harbor Codes Below is a list of the Applicable Section 4980H Safe Harbor Codes that are valid for line 16 on Form 1095C Code 2A Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Do not use code 2A for a month if theRegister for our BernieU course, Intro to Forms 1094C and 1095C, where we cover everything fromFor the months April through December, on Form 1095C, Employer A should enter code 1H (no offer of coverage) on line 14, leave line 15 blank, and enter code 2A (not an employee) on line 16 (since Employee is treated as an employee of Employer B and not as an employee of Employer A in those months), and should exclude Employee from the count of total employees and fulltime

Code Series 1 For Form 1095 C Line 14

What Your Clients Need To Know About Form 1095 C Accountingweb

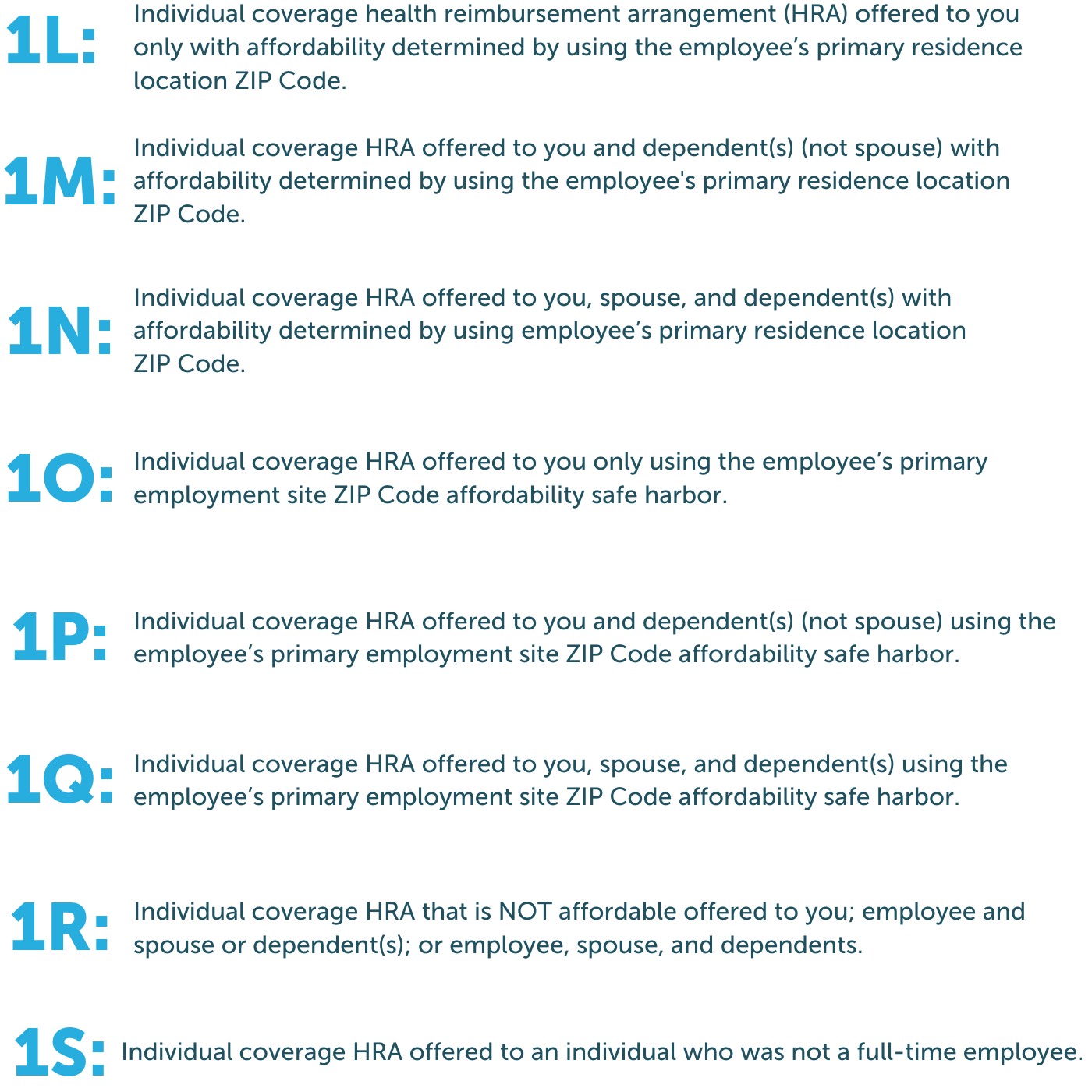

Without further ado, a breakdown of the new codes to be entered on Line 14 of the 1095C Form as provided in the new IRS draft forms 1L Individual coverage health reimbursement arrangement (HRA) offered to an employee with the affordability determined using the employee's primary residence ZIP Code 1MForm 1095C IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax creditA) Place Code 1A in any box on Line 14 where Code 1E would otherwise be placed b) Leave Line 15 (Employee's Share of Lowest Cost Monthly Premium) blank c) Provide each employee who received a qualifying offer for all 12 months a statement (rather than a copy of her/his Form 1095C) that includes • Identifying information about the employer

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

1095 C Software For Tracking Reporting Passport Software

Updated on 1030am by, TaxBandits For the calendar year , the IRS has updated Form 1095C with few changes It includes the introduction of new codes and lines for reporting Individual Coverage HRAsKeep in mind that this new form should be used only forThe IRS has issued Form 1095C, EmployerProvided Health Insurance Offer and Coverage, for ALEs to satisfy the reporting requirement under Code § 6056 If the employer selffunds its plan(s), the employer also will use Form 1095C to satisfy the additional requirement under Code § 6055Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

Aca Code Cheatsheet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updatedForm 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit Line 14 of the 1095C is where an employer reports an offer of coverage that is or is not made to an employee The offer is reported by using one of nine codes, which are referred to as "Code Series 1" codes

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

It means that the employee was not employed It typically is seen with an accompanying 1H on line 14Code Series 2—Section 4980H Safe Harbor Codes and Other Relief for ALE Members (Form 1095C, Line 16) CODE SERIES 2* 2A Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Do not use code 2A for a month if the individual was an employee of the ALE Member on any day of the calendarThe IRS has added two new codes on Line 14 of the ACA Form 1095C for meeting the mandated ICHRA Reporting Requirements!

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

Aca And The Vista Hrms Fall Update

Each Form 1095C would have information only about the health insurance coverage offered to you by the employer identified on the form If your employer is not an Applicable Large Employer, it is not required to furnish you a Form 1095C providingForm 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainland In addition to Line 14, employers must enter codes on line 16 which provide additional context around the type of coverage offered or why an offer was not made Below are the different codes that can be entered on line of the 1095C 2A This code is simple;

1095 C Employer Provided Health Insurance Offer Of Coverage

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Focus on the offer of coverage (1095C form line 14) and employee status (line 16) These codes will help IRS pinpoint individuals having insurance coverage gaps of three or more months, which in turn will trigger the individual mandate penalty Moreover,Form 1095C What is Form 1095C? The new form covers HRA plan years starting Jan 1, New codes for the 1095C For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employees

The Irs Released A New Draft Of Form 1095 C For 22 Filing By Acawise Aca Reporting Center Aug 21 Medium

Affordable Care Act 1 Properly Reporting Cobra Continuation Coverage Integrity Data

IRS Form 1095C Draft was released for the 21 Tax Year with changes What are the Changes to Form 1095C?Form 1095C, Line 15 Employee Share of Lowest Cost Monthly Premium for Self Only Minimum Value Coverage Complete line 15 only if code 1B, 1C, 1D, or

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Www Irs Gov Pub Irs Prior Ic 15 Pdf

1094 C 1095 C Software 599 1095 C Software

1094 C 1095 C Software 599 1095 C Software

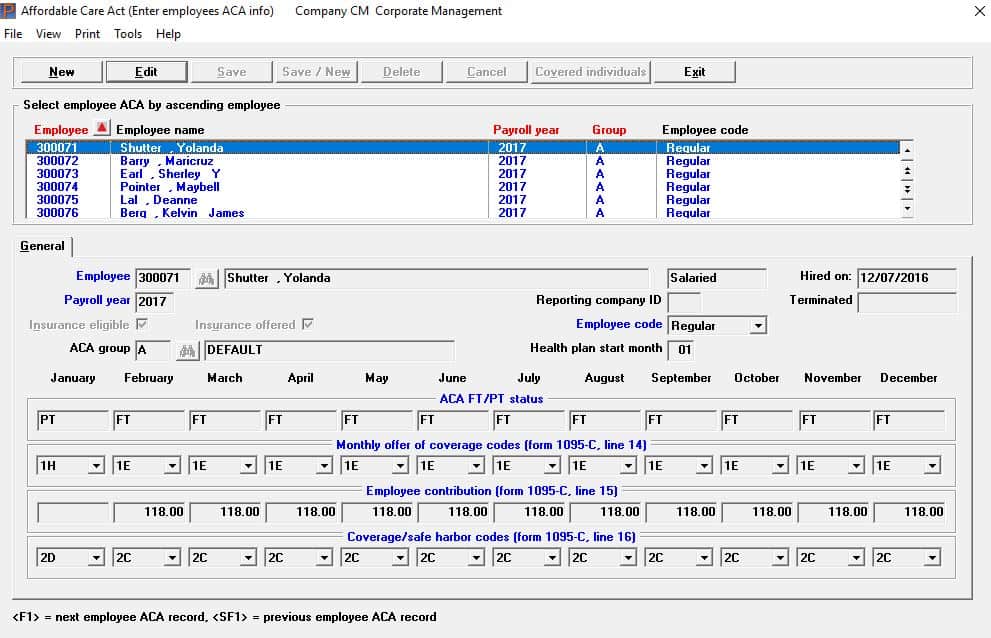

Affordable Care Act Processing

Common Mistakes In Completing Forms 1094 C And 1095 C

Irs Form 1095 C Codes Explained Integrity Data

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Accurate 1095 C Forms A Primer Erp Software Blog

1095 C Faqs Mass Gov

Form 1095 C Guide For Employees Contact Us

trix Irs Forms 1095 C

Aca Code Cheatsheet Release Notes

New 1095 C Codes For Tax Year The Aca Times

Aca Elite Generate Codes E File 1095 C Forms

Changes In Irs Form 1095 C For Taxbandits Youtube

Toast Payroll Common Combinations Form 1095 C Codes

The New 1095 C Codes For Explained

Irs Issues Draft Form 1095 C For Aca Reporting In 21

1

Http Www Fleming Kyschools Us Userfiles 4 My files Finance 1095c letter to employees Pdf Id

Www Irs Gov Pub Irs Prior F1095c 18 Pdf

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Annual Health Care Coverage Statements

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

1095 C Template Fill Online Printable Fillable Blank Pdffiller

The Aca S 1095 C Codes For The Tax Year The Aca Times

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Toast Payroll Completing Boxes 14 15 And 16 Of The 1095 C

1

Overview Of 1095c Form

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Ez1095 Software How To Correct 1095 C And 1094 C Form

Changes Coming For 1095 C Form Tango Health Tango Health

Aca Code Cheatsheet

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

What Is Form 1095 C Filing Methods Due Dates Mailing Address

Aca Reporting Faq

Accurate 1095 C Forms Reporting A Primer Integrity Data

Benefits 1095 C

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

How Can I Get Help With 1095c Instructions

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Form 1095 C Series 1 Code Map

Irs Form 1095 C Codes Explained Integrity Data

Affordable Care Act Setup

Section 6056 Large Employer Reporting Ts1099 Ts1099

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

1

What S New For Tax Year Aca Reporting Air

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Aca Code Cheatsheet

Irs Distribution Deadline March 2 21 Aca Gps

1095 C Form Official Irs Version Discount Tax Forms

Form 1095 C Released New Codes New Deadlines

Irs Form 1095 C Codes Explained Integrity Data

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

1095 C Corrections Support Center

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Your Guide To Irs Form 1095 C Part Ii Code Combinations Synchr

Cobra Retiree 1095 C Form Questions Answered Tango Health

Www Irs Gov Pub Irs Prior F1095c 16 Pdf

Consulting Americanfidelity Com Media 1435 17 11 30 17 Instruction Guide Step 1 Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Http Www Lockton Com Resource Pageresource Mkt Compliance Lines 14 And 16 Cheat Sheets Cr Pdf

Code Series 2 For Form 1095 C Line 16

What Your Clients Need To Know About Form 1095 C Accountingweb

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Code Guidance Form 1095 C Code Series 1 2 Boomtax

What You Need To Know About Aca Annual Reporting Aps Payroll

0 件のコメント:

コメントを投稿